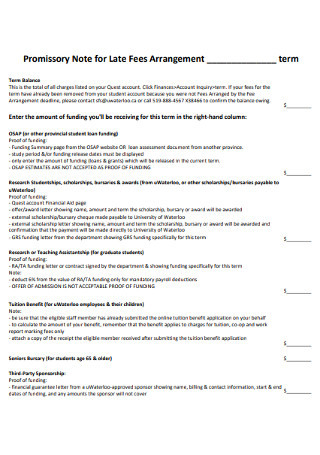

Promissory Note Tuition Fee Example | Repayment of a tuition loan by credit card is subject to a 2.3% convenience charge. A promissory note or promissory letter is a legal instrument similar in nature to any common law contract. The loan origination fee is a fee charged by your lender upon entering into a loan agreement to cover the cost of processing the loan. Promissory notes, required of both tuition and cash loans, are signed electronically at the time the student requests the loan online. Your signed and notarized promissory note must be returned to the financial aid office within 30 days of your award notification in order to receive your pilipp ii funds for the year.

A promissory note or promissory letter is a legal instrument similar in nature to any common law contract. Promissory notes, required of both tuition and cash loans, are signed electronically at the time the student requests the loan online. The loan origination fee is a fee charged by your lender upon entering into a loan agreement to cover the cost of processing the loan. The fee will be taken out of the gross amount of your loan when the funds are disbursed to the school. This agreement will be made when you sign the master promissory note (mpn) at studentaid.gov.

Once more than 60% of the semester is completed, all the title iv aid the student was scheduled to receive for the semester is earned. The fee will be taken out of the gross amount of your loan when the funds are disbursed to the school. If you're writing a promissory note for a lump sum repayment, you'll typically use a simple promissory note. Students who are enrolled in the payment plan should pay their monthly installments as planned. This agreement will be made when you sign the master promissory note (mpn) at studentaid.gov. Each day as various updates are performed. Your signed and notarized promissory note must be returned to the financial aid office within 30 days of your award notification in order to receive your pilipp ii funds for the year. In order for a contract to be enforceable, it must contain certain legal conditions such as an offer and an acceptance of that offer. Estimated scholarships (e.g., outside agency) do not reduce the amount of tuition payable on october 1 and february 1. Promissory notes, required of both tuition and cash loans, are signed electronically at the time the student requests the loan online. Make sure to check the messages on your bill — they could contain important information about your tuition and fees, as well as actions you need to take. A simple promissory note will state the full amount is due on the stated date; You will receive an email from the financial aid office by december 28 containing your award letter and a promissory note.

The loan origination fee is a fee charged by your lender upon entering into a loan agreement to cover the cost of processing the loan. The fee will be taken out of the gross amount of your loan when the funds are disbursed to the school. You won't need a payment schedule. Estimated scholarships (e.g., outside agency) do not reduce the amount of tuition payable on october 1 and february 1. You must sign a new promissory note each time you accept a purdue loan or an increase to an existing purdue.

This agreement will be made when you sign the master promissory note (mpn) at studentaid.gov. An example is lending your sibling $2,000. Your signed and notarized promissory note must be returned to the financial aid office within 30 days of your award notification in order to receive your pilipp ii funds for the year. Heartland ecsi, the third party loan servicer, will send you an email in this timeframe indicating when your promissory note is available. Students who are enrolled in the payment plan should pay their monthly installments as planned. Jun 24, 2021 · for example, if a student completes 30% of the days in the semester, the student would earn 30% of the title iv aid originally scheduled for the semester and the 70% of unearned funds is returned. You will receive an email from the financial aid office by december 28 containing your award letter and a promissory note. In order for a contract to be enforceable, it must contain certain legal conditions such as an offer and an acceptance of that offer. You won't need a payment schedule. The loan origination fee is a fee charged by your lender upon entering into a loan agreement to cover the cost of processing the loan. You must sign a new promissory note each time you accept a purdue loan or an increase to an existing purdue. Once more than 60% of the semester is completed, all the title iv aid the student was scheduled to receive for the semester is earned. Each day as various updates are performed.

Your sibling agrees to pay you money back by january 1. Once more than 60% of the semester is completed, all the title iv aid the student was scheduled to receive for the semester is earned. Repayment of a tuition loan by credit card is subject to a 2.3% convenience charge. Make sure to check the messages on your bill — they could contain important information about your tuition and fees, as well as actions you need to take. Students must make arrangements to pay for the total amount of tuition due to avoid a $100 late tuition fee and a $30 service charge.

Students must make arrangements to pay for the total amount of tuition due to avoid a $100 late tuition fee and a $30 service charge. Specifically, sbs provides answers to billing questions, payment options, loan debt entrance & exit counseling, and direct deposit authorization for refunds (available on r'web). Students who are enrolled in the payment plan should pay their monthly installments as planned. Your signed and notarized promissory note must be returned to the financial aid office within 30 days of your award notification in order to receive your pilipp ii funds for the year. Promissory notes, required of both tuition and cash loans, are signed electronically at the time the student requests the loan online. If you're writing a promissory note for a lump sum repayment, you'll typically use a simple promissory note. This agreement will be made when you sign the master promissory note (mpn) at studentaid.gov. Repayment of a tuition loan by credit card is subject to a 2.3% convenience charge. Estimated scholarships (e.g., outside agency) do not reduce the amount of tuition payable on october 1 and february 1. Your sibling agrees to pay you money back by january 1. A promissory note or promissory letter is a legal instrument similar in nature to any common law contract. Heartland ecsi, the third party loan servicer, will send you an email in this timeframe indicating when your promissory note is available. An example is lending your sibling $2,000.

Promissory Note Tuition Fee Example: Interest charged is 4% per year.

0 comments